Great Bitcoin Ideas Show the Power of One Market: Secure the Bag

by Gene Hoffman, CEO & President

In traditional finance today, an entity sending many payments to holders of their asset can easily and quickly rack up considerable fees (wire and mail fees in TradFi, and block access fees in DeFi). Those receiving payment want certainty that their payment is coming. Some may be fine waiting some hours for payment, but others may want their payment immediately.

Let’s say you have 250,000 customers, and you want to send a personal check for $4 to each of them. For each payment, you would first need to print a paper check and then send it through the mail to the correct address. The logistics involved with doing this might cost more than the actual payments. Instead, what if you could batch these payments into a single check? It would save a lot of money, but it wouldn’t be possible using paper checks and snail mail; however, this becomes trivial using the Chia blockchain.

A few years ago, one skilled Bitcoin contributor, Jeremy Rubin, devised a very creative way to significantly reduce the cost and logistics overhead of a distribution of value to many wallets at once which he named Secure the Bag.

Secure the Bag

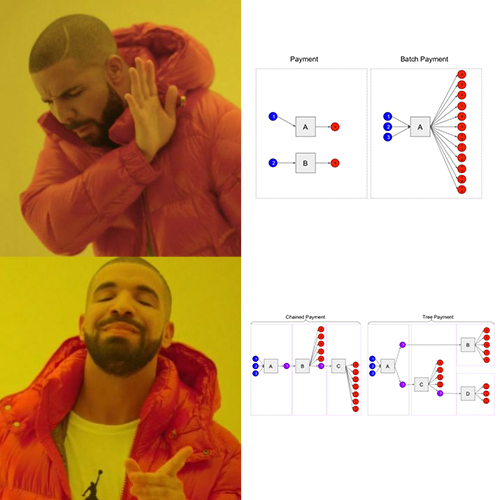

The issuer places one large transaction on-chain, including the associated amounts to be paid and their destination addresses. The fee for this transaction is much smaller than what would have been incurred from sending individual payments to each address. Coins are batched into a tree of coins with pre-designated recipients that anybody can unwind (there is no specific owner of the coins in the “bag”), and the funds are now essentially in escrow on-chain waiting for the unwind to complete. Fees can be paid by the person who is unwinding the bag, who may not be the original sender of coins in the secured bag, or paid by the recipient who wants to increase the priority of funds going to her wallet.

An example of Secure the Bag’s utility:

A radical new bond is introduced that pays interest daily at 23:59 UTC and is sold to qualified buyers on-chain. The issuer of the bond gathers the total amount of USDC due to all bondholders and then creates a snapshot of the blockchain showing the bond’s holders, along with the amounts being held at the correct time. Using the info from the snapshot, the issuer sends the required USDC and the list of wallet addresses in one transaction. Let’s say there are 250,000 bonds, and $1M is due to be paid, so each bond will receive a $4 interest payment. Even in a tight on-chain fee market, securing the bag would likely cost less than $20. The bond issuer would then apply a flat fee of, say, $50 ($0.0002 per bond) to unwind the bag. The fee included with each individual per bond is tiny so it might take a few hours for the payments to arrive. This is acceptable for the person holding four bonds and waiting on $16. On the other hand, someone holding 10,000 bonds might not want to wait as long for their $40,000. Instead, they can go to the issuer’s website and replace the default fee with a higher one, say $5 for the payment. This would then allow them to collect their $40,000 in the next block, which usually occurs in under one minute.

This capability dramatically drives down the cost of distributing debt payments or dividends—making the idea of a daily couponing bond in the example above quite feasible. As an equity issuer goes online this can significantly decrease the cost of their quarterly dividend and may be material enough of a cost savings that they can pass it on to their shareholders in a larger dividend payment.

The transaction costs only scale with the number of receive addresses being sent to (the dollar amount being sent doesn’t affect the transaction costs). This implies two things: the cost to secure the bag is only affected by the data size of the list, and the process to unwind is very flexible—especially because it can take advantage of waiting for low-fee times of the day to finish unwinding while time-sensitive folks can accelerate things to their heart’s content.

While Rubin crafted the concept of Secure the Bag for Bitcoin, it remains only a notion, as Bitcoin developers have not made progress on incorporating the necessary opcodes to implement it.

Fortunately, Chialisp makes this easy, and we deployed Secure the Bag on the Chia blockchain in July 2022.

A significant amount of the infrastructure and business patterns that people take for granted in TradFi has been driven by these historical cost issues and communication difficulties. It’s why dividends and coupons are often paid quarterly or even annually. Now, One Market can make it easy for an issuer to drive down their costs while saving everyone time and money.

original source – Chia.net